by Rennie Gabriel | Jan 20, 2019 | credit problem, Rennie's Money Musings, Resources

While it would have been better to send this email prior to the season of giving, also known as the season of profits for retailers, it is better late than never. In December my wife and I donated about $32,000 to various charities, and it is important to know where...

by Rennie Gabriel | Jun 9, 2018 | Philanthropy, Rennie's Money Musings, Resources, Social Issues

I recently attended an event where Larry Broughton spoke. You may not have heard of him; he was being interviewed by my business coach, James Malinchak. Larry owns Broughton Hotels and is an example of a business leader, and someone who gives back to the community....

by Rennie Gabriel | May 27, 2018 | Financial Information, Rennie's Money Musings, Social Issues

Do you feel you want (or need) a financial safety net? A safety net can take several forms. It could be cash in the bank, people you know who can support you, opportunities you keep on the shelf. It could be the couch of a friend, a trust fund, or a back-up job with a...

by Rennie Gabriel | May 20, 2018 | Financial Information, Rennie's Money Musings, Social Issues

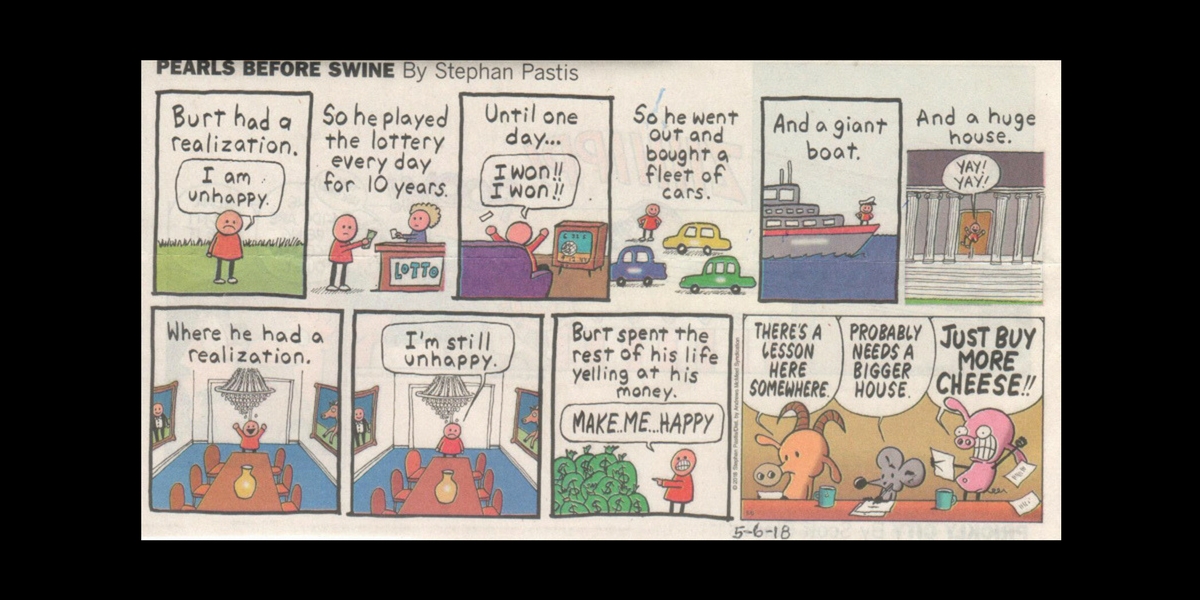

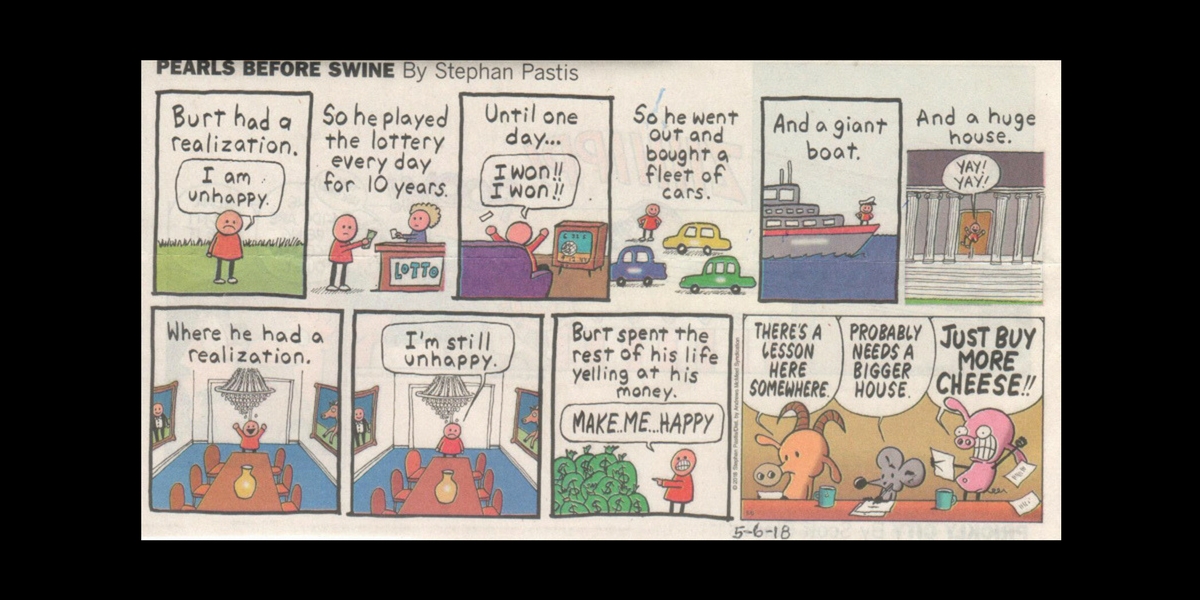

It seems like there are comics lately that I can use to talk about money, like crypto-currencies, or this week, someone who wins the lottery. To start the conversation, here is my favorite Warren Buffet quote: “Of the billionaires I have known, money just brings out...

by Rennie Gabriel | May 13, 2018 | Financial Information, Rennie's Money Musings, Social Issues

Below is a comical take on how crypto-currency works. And what about block chain technology that allows crypto-currency to exist? Here is a short answer: “The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not...

by Rennie Gabriel | Mar 3, 2018 | credit problem, Financial Information, Rennie's Money Musings

As much as Cash Call Mortgage advertises that your house is your bank, it is NOT. This is a lender that will make short term loans at interest rates that exceed 100% per year, and when they say, “Your house is your bank” and borrow money to pay off credit cards, take...